The report starts with a question:

What is normally expected to happen with finance after the crisis?

Consensus seems to be that after the crisis finance will be

-More regulated, and supervised by governments, especially as many banks are partially nationalized;

-Simpler, due to the disappearance of the demand for complex financial assets (ABS, structured products, complicated exotic options, etc.);

-More cautious about risk taking (reduction in risk limits, increased capital consumption, different compensation systems for trading floors, etc.).

But do the current developments reflect it? Let’s first look at existing background in which many banks are operating.

-Many banks in the United States and in Europe have been recapitalized by governments, so much so that some of them are practically nationalized.

-All these banks have also benefited from debt issuance guaranteed by the government.

-The aid provided by governments has been accompanied by conditions, generally regarding the compensation of management, traders, etc. This also entails a reduction in the volume of risk operations (proprietary trading).

It is striking to see that, in the recent period, many banks would:

− On the one hand recapitalize, in order to comply with the conditions (stress-tests) set by governments;

− On the other hand repay governments, in order to no longer be subject to constraints affecting the way they run their business (Table 1). This is particularly striking in the United States.

These banks in all likelihood want to return to an investment bank model close to the one seen before the crisis.

Table - 1

On 9 June the Treasury authorized 10 banks to repay the funds injected in the autumn of 2008 by the government, for a total amount of USD 68 bn.(Table2)

Table - 2

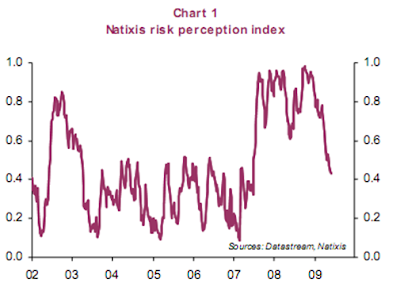

The recent period has been marked by a nose-dive in investor risk aversion (Chart 1), and, without delay, a return of demand for complex (toxic) assets, a demand that was believed to have disappeared for good:

-CDOs, as shown by the tightening in CDS spreads (Charts 2A and B);

-CDOs, as shown by the tightening in CDS spreads (Charts 2A and B);

-CLOs, as shown by the rise in the prices of leveraged loans (Chart 3); etc.

It is therefore not true that investors will only be interested in simple assets going forward.

Global liquidity is extraordinarily abundant (Chart 5), due to the highly expansionary monetary policies conducted since the start of the crisis on top of the previous surge in official reserves.

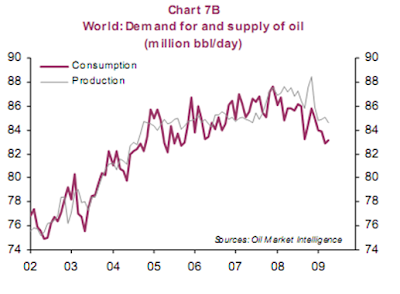

As soon as investor risk aversion decreased, asset price bubbles reappeared: surge in emerging-country equities (Chart 6), rise in the oil price despite the situation of excess supply in the market (Charts 7A and B).

As soon as investor risk aversion decreased, asset price bubbles reappeared: surge in emerging-country equities (Chart 6), rise in the oil price despite the situation of excess supply in the market (Charts 7A and B).

This demonstrates:

This demonstrates: -some banks have not changed their business model; (not wanting to learn from the previous experience).

-demand for complex financial assets has in reality remained brisk; (investors are still playing suckers).

-the excess liquidity is still causing asset price bubbles, which once more demonstrates the central banks’ responsibility in the financial chaos;(Central Banks are working hard to create another bubble).

Amen.

Disclosure: No Positions

Copyright © 2008-09 Tradesense

No comments:

Post a Comment

Look forward to your views/comments.