Tradesense (a.k.a.Horse Sense)

This Blog was launched on 9th October 2008 just after the beginning of the worst financial crises the world is witnessing and fear seems to be reaching its peak.

Sixthsense investing appears to be the need of the time!! The intention is tickle it every week.

Monday, August 17, 2009

Where is the US consumer crisis heading?

As regards China it was identified in May 09 itself that:

…China doesn’t have the kind of social safety net one sees in the developed world, so it needs to keep its economy going at any cost. Millions of people have migrated to its cities, and now they’re hungry and unemployed. People without food or work tend to riot; to keep that from happening, the government is more than willing to artificially stimulate the economy, in the hopes of buying time until the global system re-stabilizes.

It’s literally forcing banks to lend - which will create a huge pile of horrible loans on top of the ones they’ve originated over the last decade (though of course we can’t see them). Don’t confuse fast growth with sustainable growth. As I’ve discussed in the past, China is suffering from Late Stage Growth Obesity. A not-inconsequential part of the tremendous growth it’s seen over the last 10 years came from lending to the US. Additionally, the quality of late-period growth was, in all likelihood, very poor, and the country now suffers from real overcapacity.

Identifying bubbles is a lot easier that timing their collapse. But as we’ve recently learned, you can defy the laws of financial gravity for only so long. Put simply, mean reversion is a bitch. And the longer inflated prices persist, the harder they fall when financial gravity brings them back to earth.”

It was also noted in early June 09 that:

…However, if there is to be a risk of a credit crisis in the future in China, similar to the one that has unfolded in the United States and Europe, the country would need to lack any other possible engine of growth.

In the United States and Europe, if credit had not outpaced incomes, growth would have been close to potential growth, i.e., in view of productivity gains and growth in the working-age population, around 2.25% in the United States, 1% in the United Kingdom and 1% in the euro zone. Credit was used to ensure more robust growth than would otherwise have been recorded.

In China, the current economic recovery is driven by credit; but there are exceptional circumstances with, for instance, the decline in China’s exports due to the contraction in global trade.

In a normal regime, productivity gains are high and potential growth is robust in China, and this rules out the need for a durable increase in indebtedness to stimulate growth.

However, it may well be that the current vigorous upturn in credit, driven by the government’s instructions, with loans extended at very favorable conditions for borrowers, could lead to the reappearance of non-performing loans in banks’ balance sheets, and the Chinese government will likely have to pay for them in the future as it already has done in the past.

And in January 09 it observed that:

The $584bn.China stimulus is expected to start having some impact from the second quarter. But the main factor would be the expected revival of the western markets after the second quarter which would then give a fillip back to Chinese exports. If this for some reason does not happen or is delayed than we may see some serious dumping by China causing prices worldwide to fall and adding to the deflationary trend. This could lead to protectionist tendencies to increase leading to a global slowdown in trade with attendant political and economic consequences.

As regards the market and FED it was observed in early May 09 that:

…The feel good factor is back. Many experts opine that we have indeed put in a bottom and that with due corrections we shall now march upwards. The fact that most were talking about a recovery that would be shaped L, U, W etc., contrary to the expectations as markets usually do, many experts think the market in its wisdom has sought a V shaped recovery….

…This is not to say that some of the macro parameters have not improved. But this sharp move up of the market has its consequences. The increasing appetite for risk has seen the US 10 year yield move up to 3.2% and the mortgage rates are up from around 4.7% to around 5.2%. And as explained in a previous post sharp up moves in equities is going to make the treasury and the Fed’s trillions of borrowing more expensive pushing up the interest higher which will increase risk for taxpayers and the country dramatically. Hence while printing money the Fed and treasury have to do a fine balancing and that means the interest rates still needs to managed within reasonable levels. This is not going to be easy and is going to be a fine line to tread on, not knowing where the line is.

Now here is the catch. On the one hand this would mean funding the bailouts is going to be more and more difficult and expensive while on the other hand liquidity will find its way to other asset classes. While the short term shift in liquidity to stocks and other assets may move these markets, sooner than later the reality of high interest rates and the inability/difficulty of funding the bailouts other than through FED buying more and more treasuries (printing money or quantitative easing) will become apparent. This we have experienced many a times is a sure shot formula for asset prices to finally form a bubble and lo! we are back to square one.

To me the market players should not get euphoric with current move. The players shifting their liquidity to the market to create such sharp moves would be actually shooting at their own legs. A measured slow consolidation is required and sharp move in asset prices will put the medium to long term sustained recovery in jeopardy. This whole process will be time consuming – running into number of years and the market player’s own action on a collective basis of how they handle this liquidity is going to determine how long the markets may take to make a long term sustainable up move.

On why the seeds decoupling have been sown, it was observed in February 09 that:

…As I see the lessons learnt/being learnt during this severe downturn will have a lasting impact as these Asian countries now re-orient there industrial and fiscal policies to ensure that over dependence on exports is reduced in the years to come. Also trade within the region will now be a much greater focus as two of the most populous countries in the region ‘Chindia’ look to push their growth with policies that are much more domestic investment and consumption oriented. India always was domestic consumption story (save the IT and IT enabled services and Generic Pharmaceutical industry) and now can be regarded as a great advantage.

… the reorientation will be challenging and will take time – a decade or so. But as the US and European consumption story sees its twilight in years to come it is the Asian and some of the resource rich countries such as Brazil that will need to fill-in. And as this re-orientation sees initial success foreign capital (US and European savings) will start seeking these countries and the capital required to sustain a reasonable growth rate will find its way. The seeds for this shift – possibly a power shift too - appears to have been sown.

The point to be understood is that normal downturns/recessions happen due to businesses over investing and generally the interest rates shooting up (through central bank actions) because of inflationary concerns causing demand to ease. The overcapacity brings down prices and as inflationary concerns diminish the interest rate environment softens and we see demand picking up and capacity utilization also move northward indicating revival. The underlying money circulatory system or credit delivery generally remains in reasonable health, although specific concerns may be there.

However the genesis of the current downturn/recession is the failure of this underlying system of credit delivery and money circulation which has its own attendant consequences. The businesses and consumers got into trouble because what they thought was a given (within a certain flexibility band of size or amount and price of credit) suddenly found the ground dry and had to face tight liquidity situation and thereby cut production/purchases etc.

The former situation is akin to an organ or two malfunctioning and with some external medication which can reach the organs through the circulatory system and body’s other organs/systems responding in help, the health can be restored reasonably fast – V shaped recovery. But if the body’s circulatory system is itself damaged and is the cause for other organs malfunctioning it becomes a real challenge to restore the health of the person as the medication has to given directly to the organs in the hope that their improving condition would stimulate the circulatory system and thus the patient’s health can be restored. How this will pan out is difficult to say – L, W, U and hopefully not X.

As Washington Post notes:

“…Growth spurts can emerge, and it appears increasingly likely that the U.S. economy will grow at a solid pace in the second half of the year, as companies restock depleted inventories. But it is unclear what would come after that, given the ongoing restrictions on credit.

U.S. banks have sustained massive losses already, and a wave of soured commercial real estate loans threatens to further limit their ability to lend in the year ahead. A bigger problem looms outside of banks -- in credit markets, which account for vast chunks of mortgage lending, consumer loans and commercial real estate loans. This shadow banking system remains dysfunctional -- notwithstanding a slew of programs the Fed put in place to get it going again -- and no one is sure when or whether it will recover.

All that makes it more expensive for people or businesses to borrow money -- if they can get a loan at all -- which could serve as a powerful brake on any recovery.

"Credit fuels housing. It fuels consumer durable goods. It fuels business investment. It's in every part of the economy," ... "Credit makes recessions after a financial crisis longer, and all the signs are that [it] is happening this time as well."

…The financial crisis and recession are reversing a 30-year trend carrying Americans toward a high point in debt. The ratio of consumer debt to the nation's total economic output rose to 97 percent in the first quarter of this year from 45 percent in 1975.

Currently, Americans are saving more and paying down debt; the savings rate was 1.2 percent of disposable income in early 2008. By the second quarter of this year, that rose to 5.2 percent.

Every dollar that Americans save is one fewer dollar for consumption, which means less economic output. When the savings rate goes up by a percentage point, spending decreases by more than $100 billion…”

So what will bail out American, Chinese and other businesses that are so dependent on the US consumer? The answer to this is the growth of the merging market consumers. As noted above as the US consumer dependant economies focus more on internal consumption and make moves to improve the living standards of their populations through better infrastructure, creating more job opportunities etc., the demand for goods worldwide will start looking up over time. American businesses will have to position themselves to exploit this opportunity.

Remember what the US consumer saves has to find its way to businesses or consumers elsewhere. This capital will flow to where the growth opportunities are – the emerging markets. And as these markets start providing the depth in demand (because of sheer numbers and necessarily due to credit explosion in these countries), American businesses will find its footing in the scale that they were/are used to. This reversal of fortune is going to take a lot of time. US companies already established in these regions will be the first to experience this shift and those focused within the US will have to think globally.

Slowly the cycle will turn, but for now situation seems too challenging for comfort.

Disclosure: No Positions

Copyright © 2008-09 Tradesense

Saturday, June 20, 2009

Have Banks Learnt Anything From The Financial Crisis?

-More regulated, and supervised by governments, especially as many banks are partially nationalized;

-Simpler, due to the disappearance of the demand for complex financial assets (ABS, structured products, complicated exotic options, etc.);

-More cautious about risk taking (reduction in risk limits, increased capital consumption, different compensation systems for trading floors, etc.).

-Many banks in the United States and in Europe have been recapitalized by governments, so much so that some of them are practically nationalized.

-All these banks have also benefited from debt issuance guaranteed by the government.

-The aid provided by governments has been accompanied by conditions, generally regarding the compensation of management, traders, etc. This also entails a reduction in the volume of risk operations (proprietary trading).

It is striking to see that, in the recent period, many banks would:

− On the one hand recapitalize, in order to comply with the conditions (stress-tests) set by governments;

− On the other hand repay governments, in order to no longer be subject to constraints affecting the way they run their business (Table 1). This is particularly striking in the United States.

-CDOs, as shown by the tightening in CDS spreads (Charts 2A and B);

-CDOs, as shown by the tightening in CDS spreads (Charts 2A and B);

It is therefore not true that investors will only be interested in simple assets going forward.

Global liquidity is extraordinarily abundant (Chart 5), due to the highly expansionary monetary policies conducted since the start of the crisis on top of the previous surge in official reserves.

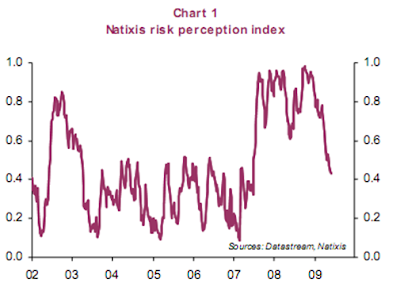

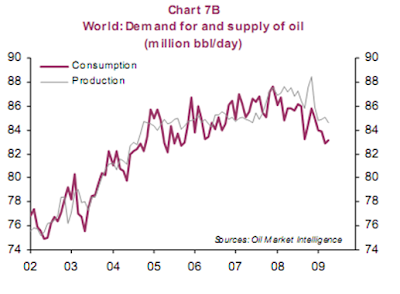

As soon as investor risk aversion decreased, asset price bubbles reappeared: surge in emerging-country equities (Chart 6), rise in the oil price despite the situation of excess supply in the market (Charts 7A and B).

As soon as investor risk aversion decreased, asset price bubbles reappeared: surge in emerging-country equities (Chart 6), rise in the oil price despite the situation of excess supply in the market (Charts 7A and B).

This demonstrates:

This demonstrates: -some banks have not changed their business model; (not wanting to learn from the previous experience).

-demand for complex financial assets has in reality remained brisk; (investors are still playing suckers).

-the excess liquidity is still causing asset price bubbles, which once more demonstrates the central banks’ responsibility in the financial chaos;(Central Banks are working hard to create another bubble).

Disclosure: No Positions

Sunday, June 7, 2009

Why the US stock market is stalling?

Explanations could be along these lines.

-Home prices appear to have hit bottom in some areas of the country, but construction remains weak.

-The auto industry and retailing remain in distress. The job market is likely to remain in the doldrums for many months.

-A home foreclosure crisis is growing … As more foreclosed properties land on markets, real estate prices are falling further, adding to the losses and uncertainties confronting banks.

-Wage growth has been stagnating even as gasoline and medical costs rise, putting pressure on household finances. Average hourly wages were 3.1 percent higher last month than they were in May 2008, but the month-to-month increases in April and May were just 0.1 percent, to a seasonally adjusted $18.54, from $18.52, according to the Labor Department. Wages for manufacturing workers fell 0.1 percent.

-The jobs report presented a statistical puzzle. After shedding an average of more than 700,000 jobs each month during the first quarter, the economy lost 504,000 jobs in April, according to revised data, and the number was smaller still in May. Yet the unemployment rate leapt from an already high 8.9 percent, reinforcing fears it would reach double digits.

This disconnect owes to the way in which the government collects data. The number of jobs comes from a survey of employers, while the unemployment data is derived from a survey of households. In April and May, the number of people who told surveyors they were actively looking for work increased by more than one million. These people would have previously been considered outside the work force and thus excluded from the unemployment calculation. Now, they are officially back in the hunt, yet struggling to secure work.”

And to me this discomfort comes from the rising treasury yields. Says a NYT report

“The Treasury’s benchmark 10-year note fell 30/32, to 94 7/32, as investors edged away from buying government debt in the face of exploding federal deficits.

The yield, which moves in the opposite direction from the price, rose to 3.83 percent, from 3.71 percent late Thursday, and was up from 3.46 percent a week ago.

The creep toward higher interest rates represents a return to normalcy in some ways…

But higher interest rates on Treasuries make it more expensive for the government to borrow trillions in new debt, and they also raise mortgage rates for home buyers, threatening the government’s efforts to keep borrowing costs low.

But higher interest rates on Treasuries make it more expensive for the government to borrow trillions in new debt, and they also raise mortgage rates for home buyers, threatening the government’s efforts to keep borrowing costs low.”

This is something I have mentioned in my previous post as a key risk for the US market and is now emerging an important headwind.

A Miller Tabak + Co., LLC report brings out the concerns even more clearly:

“The action in the two year note today where the yield is up a dramatic 30 bps to 1.25%, the highest since mid November, is happening coincident with a move higher in yield in the fed funds futures contracts where the market has somewhat reset their expectations of what the Fed will do. The fed funds futures are pricing in a 48% chance of a 25 bps rate hike by the September 09 meeting and that is up from a 2% chance priced in just yesterday.

After today’s better than expected payroll figure being the main catalyst for today’s action in conjunction with the ever growing inflation concerns, the Fed needs to decipher what is a readjustment of growth expectations and/or what is related to inflation concerns and whether they will fight these trends in order to keep interest rates low.

Reading comments from Fed President and voting member of the FOMC Yellen within the past 15 minutes does not give much confidence that they know what’s going on and it seems that they had very little of a game plan going into their QE policy. Using quotes from DJ, she said that while buying MBS and US treasuries got off to a good start with yields heading lower, “there’s a lot that central bankers don’t know about the magnitude and duration of the effects of these policies” and “our standard monetary policy models do not incorporate financial frictions that lead to asset purchases having real effects.” She went on to say “we lack both the data and theory to provide strong guidance on these policies” and “we are sailing in uncharted waters, marking our maps with every bit of information along the way.” Yellen is a career economist and ex school professor so she’s learning first hand what its like to mess with the market. I’m worried if other Fed members are this uncertain.”

Fed not knowing what it is up to is a concern expressed before.

Another commentator albeit in a different context brings home the point regarding the long term yields.

“Listen, what really matters to energy prices these days is the perceived value of the dollar and the perceived ability of the government to stop its massive spending binge. Oil has been moving because of the disturbing widening of the yield curve that seemed to suggest that the government’s ability to keep rates down in the long end would make every dollar the government spends that they do not have more and more expensive to pay back. Oil moved because it saw the threat posed by the widening yield curve and it expressed those concerns with soaring gold and silver prices, ratcheting up copper prices. Not to mention talk in recent weeks that the untarnished best in the universe debt rating of the United States of America’s was even rumored to be downgraded.

And you Mr. Grumpy Bernanke have to go ruin it all by saying enough is enough. Why tell the Senate and Obama and the rest of America that we can’t have our cake and eat it too? I like cake! Don’t tell us that we cannot have it all like universal health care, finance Social Security, buy out auto companies, bail out Fannie and Freddie, massive stimulus packages and speculating in the green energy space and at the same time drive down the dollar and make commodity speculators rich. What kind of downer talk is that? Whenever you think that way remember there has never been anything false about hope. We have faced down impossible odds. We've been told that we're not ready, or that we shouldn't try, or that we can't afford it because our budget deficits threaten financial stability or we can’t because of our threatened ability to borrow indefinitely to fund a budget deficit that already this year is estimated to be $1.85 trillion, equivalent to 13 percent of the nation’s GDP the highest level since World War II. Or that we can’t because we are on path that will make this country bankrupt, just remember that generations of Americans have responded with a simple creed that sums up the spirit of a people. Yes we can! Yes we can! Commodity bulls all over the world thank you.”

Assuming the US authorities do get their exit strategy right and is able to balance the rate vs. growth concerns - will the global developments allow this to happen? To me it looks extremely difficult. According to a Natixix special report:

“The rise in long-term interest rates (particularly in the United States) is very bad news, since a fall in long-term interest rates was the only policy left for central banks.

What accounts for this rise?

− Inflationary risk due to the scale of monetary creation? But if expected inflation rises, there is no real inflation risk and, moreover, the US and European economies will remain very weak for a long time to come;

− Crowding-out effects due to the size of the expected public debts? But private indebtedness continues to fall and the savings rates keeps rising;

− Contagion from higher returns that can now be obtained, for instance on emerging-country equities, due to the economic recovery in Asia?

This third argument (correlation of bond yields in the United States and Europe with returns on other financial assets) seems the most reasonable in our view; it corresponds to a return of capital flows to emerging countries.”

And will emerging countries be able provide a much higher sustained returns to keep this flow sustained. To me this looks a possibility although it does tread into the decoupling argument which I had dealt in a previous post.

Natixix looks at China’s ability to sustain a 9%+ growth on the following lines. In the context of the growth in credit in China (which can be applied to many large emerging economies) it says:

“…However, if there is to be a risk of a credit crisis in the future in China, similar to the one that has unfolded in the United States and Europe, the country would need to lack any other possible engine of growth.

In the United States and Europe, if credit had not outpaced incomes, growth would have been close to potential growth, i.e., in view of productivity gains and growth in the working-age population, around 2.25% in the United States, 1% in the United Kingdom and 1% in the euro zone. Credit was used to ensure more robust growth than would otherwise have been recorded.

On the other hand:

“Productivity gains, in China, are accounted for by what are normal factors in an emerging country:

− Migration from the countryside into cities, as the productivity of migrants improves significantly, as is reflected by the income differential between cities and the countryside;

−Very high level of investment;

− Technology transfers via direct investment.

…growth can be estimated at 9% per year at least. There is accordingly no reason why it would be necessary, in a normal situation, to boost demand by credit in China, and this in fact explains the medium-term stability of the credit-to-GDP ratio in China...

...The causes of productivity gains in China are durable, and this implies that potential growth will remain robust for a long time, resulting in a situation where there is no long-run need for a sharp rise in debt ratios.

In the United States and Europe, the low level of potential growth in comparison with the robust growth one wants to achieve has led to a steep rise in debt ratios being used, and this sparked the crisis because of excess indebtedness.

In China, the current economic recovery is driven by credit; but there are exceptional circumstances with, for instance, the decline in China’s exports due to the contraction in global trade.

In a normal regime, productivity gains are high and potential growth is robust in China, and this rules out the need for a durable increase in indebtedness to stimulate growth.

However, it may well be that the current vigorous upturn in credit, driven by the government’s instructions, with loans extended at very favorable conditions for borrowers, could lead to the reappearance of non-performing loans in banks’ balance sheets, and the Chinese government will likely have to pay for them in the future as it already has done in the past.” (US & Europe are no different).

Disclosure: No Positions

Copyright © 2008-09 Tradesense

Sunday, May 10, 2009

Stress Test For The Street

NYT reports

"A day after the bank stress tests were released, two major institutions, Wells Fargo and Morgan Stanley, handily raised billions of dollars in the capital markets on Friday to satisfy new federal demands for more capital. A third, Bank of America, hastily laid out plans to sell billions of dollars in new stock.

The speed and ease with which the banks swung into action, combined with a surge in financial shares, was hailed as a sign that confidence was returning to the financial industry. The sales seemed to put to rest questions about whether big banks would be able to lure private investors, rather than have to turn to the government again.

Before the results were made public, many of the larger banks successfully pushed the government to minimize the capital they needed to raise.

…With some off to such a rapid start — Goldman Sachs raised $5 billion before the stress test results were announced — the race is now on among the most robust to repay the government money they received last fall and so escape from government control. "

Most probably they not want to loose the control over the government?

The script which I mentioned in my previous post is unfolding further. The models and inputs, it is understood were provided by the industry and it is understood that the inputs for the test were not independently checked for its veracity thoroughly. 180 examiners examining 19 banks, many with very large and global operations over eight weeks could have seen only what the banks wanted them to show. Anyone who has worked in bank operations would vouch for that. And the icing was that the banks could negotiate the capital it required! Further the scenarios for which the banks assets were stressed were according to keen observers, was a little too optimistic. Also the fact that there were leaks which now match the actual also lend credence to this stage management. It would be good to find out as to who invested in the bank issues. The quirky feeling is that TARP money in getting circulated indirectly. Competitors holding hands for a cause!

The NYT report quotes Meredith Whitney:

"But Meredith A. Whitney, a prominent banking analyst, said the results underscored the difficulties banks faced.

“The revenue environment is very different,” Ms. Whitney said. Given the recession, banks are not going to make much money from credit cards or originating mortgages, she said. And even if all the banks secured more capital, they still might not lend, holding back the economy."

The same report says:

"Despite the sobering outlook, the mood on Wall Street was generally upbeat after the rosier-than-expected assessment of the biggest banks. The stock market climbed, with the Standard & Poor’s 500-stock index gaining 2.4 percent on Friday.

“If there were holes in this, the market would have seen it,” said Stuart Plesser, an analyst at Standard & Poor’s."

I wish the market had seen the coming of sub-prime in 2005-06 and the rating agencies it appears are never going to learn! Or probably they are also the part of script!!

To me all this is blind (Treasury & Fed) leading other blinds (banks) in the hope that miraculously both will suddenly find vision. First part has been enacted to make the audience (street) believe that both indeed have sight. How far these players are willing to take this make-belief is anybody’s guess. To me the stress test for the street has only begun.

For the sake of so many retail investors I do hope that the miracle does happen.

Disclosure: No Positions

Copyright © 2008-09 Tradesense

Sunday, May 3, 2009

Manipulonomics

This is not to say that some of the macro parameters have not improved. But this sharp move up of the market has has its consequences. The increasing appetite for risk has seen the US 10 year yield move up to 3.2% and the mortgage rates are up from around 4.7% to around 5.2%. And as explained in a previous post sharp up moves in equities is going to make the treasury and the Fed’s trillions of borrowing more expensive pushing up the interest higher which will increase risk for taxpayers and the country dramatically. Hence while printing money the Fed and treasury have to do a fine balancing and that means the interest rates still needs to managed within reasonable levels. This is not going to be easy and is going to be a fine line to tread on, not knowing where the line is.

Prechter explaining his logic for Dow 1000 says:

“The primary reason I believe the Dow is going to fall that far is its Elliott wave structure, which calls for it. But I can also see a monetary reason for this event. The tremendous inflation of the past 76 years has occurred primarily by way of instrument of credit, not banknotes. Credit can implode.

The only monetary outcome that will make sense of the Elliott wave structure is for the market value of dollar-denominated credit to shrink by over 90 percent. Given the eroded state of capital goods in the U.S. and the depletion of manufacturing capacity, it is not hard to see why all these IOUs have a deteriorating basis of repayment. The future has already been fully mortgaged; it's time to pay. But there is no money to pay, only more IOUs, which cannot be paid, either. So the credit supply (after a brief respite) will continue to shrink, which means that wealth, and therefore purchasing power, will disappear along with it. In the broadest sense, this change will constitute a collapse in the "money supply."

Apart from the sentiment angle there seems to be another perspective. The results of the bank stress tests. It was quite clear to the authorities that post these results many of the banks will need to raise more capital. Given the coziness that they have with many of these big banks – (this interesting NYT piece brings it out) and that the lawmakers may not be very inclined to commit more tax payer dollars, the need for market sentiment to improve was a necessity. The postponement of the stress test results is a result of contention between the banks and the treasury/Fed according to reports.

Also Bloomberg reports:

“Miller, a former bank examiner, said his estimate assumes regulators will require banks to maintain tangible common equity, one of the most conservative measures of capital, equal to 4 percent of their risk-weighted assets over the next two years, to withstand losses in case the recession worsens. The tests, originally scheduled for release on May 4, are set to be disclosed after U.S. markets close on May 7, according to a government official who spoke on condition of anonymity.

Bank of America Corp., JPMorgan Chase & Co., Citigroup Inc. and the 16 other banks received preliminary results last week and have been debating the findings with regulators. Officials favor tangible common equity of about 4 percent of a bank’s assets and so-called Tier 1 capital worth about 6 percent, people familiar with the tests say. Tangible common equity, or TCE, is a gauge of financial strength that excludes intangibles such as trademarks that can’t be used to make payments. Tier 1 capital is a broader measure monitored by regulators.

“When you start talking about 4 percent on risk-weighted assets based on the stress test two years out, most banks will be required to raise more capital,” Miller said in an interview yesterday. “I believe it will be as high as 14.” He declined to name them.

Citigroup, which has already taken $45 billion in U.S. taxpayer funds to shore up its finances, may need to raise as much as $10 billion in new capital, the Wall Street Journal reported today, citing people familiar with the matter. Jon Diat, a spokesman for the New York-based bank, declined to comment.”

As one commentator pointed out that we are in the mess that we are due to various models for derivatives/securitization being used and now we are trying sort it out by another modeling exercise!! One has seen the efficacy of these exercises and of course the possibility that they may show what they believe should be, need not surprise.

Respected and well regarded investors also have very sharp points to make. Bloomberg reports:

“Berkshire Hathaway Inc. Vice Chairman Charles Munger, whose company is the largest private shareholder in Goldman Sachs Group Inc. and Wells Fargo & Co., said banks will use their “enormous political power” to prevent changes to the industry that would benefit society.

“This is an enormously influential group of people, and 90 percent of that influence is being spent to gain powers and practices that the world would be better off without,” Munger, 85, said yesterday in an interview with Bloomberg Television. “It will be very hard to accomplish the kind of surgery that would be desirable for the wider civilization.”

Munger said the financial companies spent $500 million on political contributions and lobbying efforts over the last decade. They have a “vested interest” in protecting the system as it exists because of the high levels of pay they were earning, he said. The five biggest U.S. securities firms, only two of which still exist as independent companies, paid their employees about $39 billion in bonuses in 2007.

“They would like to get back as closely as possible to business as usual, and they have enormous political power,” he said.”

There are some other very valid points of view that are difficult to ignore:

1. Since last fall, our financial wizards have promised $12.8 trillion in bailout funds to primarily well connected cronies. The US national debt since the birth of this great nation now stands at a comparable $11 trillion. None of these debts will ever be paid off and it’s hard to fathom how anyone believes to the contrary.

The Fed’s “balance sheet” is supposed to be the substance behind their issuance of money. This balance sheet has been comprised of smoke and mirrors for decades since the total fiat era started in 1973. Those days now look golden compared to the current makeup.

The Fed used to hold almost exclusively Treasury securities with which to perform their various “operations”. Only 24% of their holdings are now in Treasuries. The rest is a toxic soup that they’ve now taken on (mortgage backed securities, commercial paper, money market assets, failed crony paper, etc.) to keep the entire system afloat. The mortgage backed securities, for example, are really worth around 35% on the dollar. The Fed and other banks holding this junk assign pretend values of 100% on them.

The Fed balance sheet had more than doubled to $2.19 trillion since the global meltdown started. It looks like they took the “good bank – bad bank” scenario seriously but made the wrong choice. Watching the world’s most influential bank implode is a rare event.

Most local banks are FDIC insured. These banks also hold just over $200 trillion in obscure derivatives. The reserves to back up these positions are a mere 3.5% as opposed to a more normal 10% backing of solid and traditional loans. Banking gone wild.

More here…

2. The banks are back. Profits are up. Write downs are lower. The government has their back. And the worst is over.

Forget Swiss-based USB. Their huge losses were the exception…

Judging by their latest quarterly reports, big banks have finally figured out how to make money again.

Goldman Sachs, JPMorgan, Bank of America, Wells Fargo and even Citigroup all reported profits for the first quarter.

But a closer look under the hood reveals that many of the big banks reported fake earnings…

-Bank of America arbitrarily increased the value of its Merrill Lynch assets.

-Goldman Sachs bunched much of its losses into the month of December – a month it skipped reporting on this year.

JP Morgan’s bonds fell in price. And that perversely allowed the bank to increase its bottom line. This is how the New York Times explained it: “Theoretically, JP Morgan could retire them and buy them back at a cheaper price; that’s sort of like saying you’re richer because the value of your home has dropped.”

More here…

While China is being touted as a savior there is a very interesting point of view on the coming of a China bubble.

“China’s fortunes over the past decade remind me of Lucent Technologies in the 1990s. Lucent (now Alcatel-Lucent (ALU)) was selling equipment to dot-coms. At first, its growth was natural, the result of selling telecom equipment to traditional, cash-generating companies. Thereafter, it was only semi-natural: Dot-coms were able to buy Lucent’s equipment only by raising money through private equity and equity markets, since their business models didn’t factor in the necessity of cash-flow generation.

Funds to buy Lucent’s equipment therefore quickly dried up, and the company’s growth should have decelerated or declined. Instead, Lucent offered its own financing to dot-coms by borrowing and lending money on the cheap to finance the purchase of its own equipment. This worked well enough - until the time came to pay back the loans.

The US, of course, isn’t a dot-com. But a great portion of our growth came from borrowing Chinese money to buy Chinese goods - which means that Chinese growth was dependent on that very same borrowing.

Now the US (and the rest of the world) is retrenching, corporations are slashing their spending, consumers are having moments of sickening recognition - and the consumption of Chinese goods is on the decline. This is where my dot-com analogy breaks down. Unlike Lucent, China has nuclear weapon. It can print money at will, and can simply order its banks to lend; this is a communist-command economy, after all. Lucent is now a $2 stock - but China won’t go down that easily…

…China doesn’t have the kind of social safety net one sees in the developed world, so it needs to keep its economy going at any cost. Millions of people have migrated to its cities, and now they’re hungry and unemployed. People without food or work tend to riot; to keep that from happening, the government is more than willing to artificially stimulate the economy, in the hopes of buying time until the global system restabilizes.

It’s literally forcing banks to lend - which will create a huge pile of horrible loans on top of the ones they’ve originated over the last decade (though of course we can’t see them). Don’t confuse fast growth with sustainable growth. As I’ve discussed in the past, China is suffering from Late Stage Growth Obesity. A not-inconsequential part of the tremendous growth it’s seen over the last 10 years came from lending to the US. Additionally, the quality of late-period growth was, in all likelihood, very poor, and the country now suffers from real overcapacity.

Identifying bubbles is a lot easier that timing their collapse. But as we’ve recently learned, you can defy the laws of financial gravity for only so long. Put simply, mean reversion is a bitch. And the longer inflated prices persist, the harder they fall when financial gravity brings them back to earth.”

While many key indicators may be looking better the fact that the financial system will take a lot of effort and time to straighten out should not be lost sight of. How much ever smoke screen you create at some point the realities will surface with a lot of pain.

Disclosure: No Positions

Copyright © 2008-09 Tradesense

Saturday, April 4, 2009

New Fair Value Rules – How Risky is the Game?

The Bloomberg report (linked above) says:

“Changes to fair-value, or mark-to-market accounting, approved by FASB today allow companies to use “significant” judgment in gauging prices of some investments on their books, including mortgage-backed securities. Analysts say the measure may reduce banks’ write downs and boost net income. Firms could apply the changes to first-quarter results.”

According to a MarketWatch report:

“Another provision that the FASB board approved would allow companies to put certain illiquid debt assets, such as mortgage securities, they would otherwise have been forced to write down into a category called "other comprehensive income." As a result, financial institutions' operating income is improved because they can record a lower amount of loss in their income statements.

These are illiquid securities that are "impaired," which means companies no longer believe they can collect all the amounts due."

It is estimated that this move would help raise the bank industry earnings by about 20 percent. And what would be illiquid or distressed asset? The rule will applicable to all transactions for which there is no active market and will be considered distress unless proven otherwise!

Of course the board also called for additional disclosure. As per the above report:

“The measure also requires expanded disclosure: Corporations must provide more details, on a quarterly basis, about the methodology they used to justify putting certain assets in the "other comprehensive income" category.”

An informed writer commented thus:

“I'd argue that this won't result in banks writing up their asset valuations. Think about it. Say XYZ Bank announces some huge quarterly EPS figure, but when the analysts look deeper into the number, it turns out it was all paper gains on Level 3 assets. Investors would universally pan the earnings figure, claiming it was all phantom profits on marks to make-believe valuations.

Conversely, let's say the same bank reports break-even earnings with no change in Level 3 and a healthy increase in loan loss reserves. Now what does the market think? Analysts would say that the bank has potential latent gains in their Level 3 portfolio that haven't been recognized.This market is all about imagination.

If you are a bank (or any financial), the market isn't going to just accept your balance sheet as reported. The market is going to try to imagine what your balance sheet is really. Since no one knows what it is really worth, investors are going to imagine. I argue that a bank is better off convincing the market that it is being too conservative, thus guiding the imagination to better times.”

Another author amplified this further:

“The second thing I learned as a bank trainee, back in the good old days, was that it is impossible to learn anything useful about a bank by reading its balance sheet. Whether a bank is strong or not, depends upon the quality of its assets — information that is woefully absent from financial statements.

Once we understand that banks are insolvent and require government guarantees to continue in business, the question becomes what percentage of liabilities have government guarantees and which assets are good, or whether the government will eventually have to step in, liquidating the bank and paying off depositors, leaving zilch for shareholders.

Now accounting rules don’t require banks to list their loans, nor to indicate terms and covenants of each financial asset. You’re not told the credit rating of borrowers, or even the weighted average of credit ratings (even if you put faith in credit ratings).

Nor do accounting rules require that auditors actually evaluate the likelihood that a bank will get its money back on a particular loan, or any group of loans. Bank auditors don’t visit bank borrowers one by one and look them in the eye to see if they seem credit worthy, or whether they are drunken bums that have just blown the bank’s money at the racetrack.

Moreover, large international banks are so huge and complicated, composed of thousands of subsidiaries, affiliates, side ventures, and special deals, and subject to the risk that some obscure trader in one of hundreds of countries where they do business may be hatching up a scheme that will bring the bank to its knees tomorrow morning — these banks are so complicated that it is literally impossible to contrive any document that could possibly “protect investors” by supplying all relevant and material information.

Now, auditors don’t like to admit that bank balance sheets are bullsh*t, and that that the millions spent on auditing — for the benefit of “investors” — might just as well have been donated to charity. So they try to find some way to get someone else to give an opinion on how much bank assets are worth — at least some part of the assets.”

So are we in a better position to assess banks post the accounting changes? In other words are bank financials better than before the rule change? Remember most CEOs sometime back said things were hunky-dory and sub-prime was not a big problem! They either did not have a clue or knew but purposely suppressed facts. I do not see how this behavioral aspect can be altered by a change in accounting rule... even if they became government run banks.

Has the underlying risk really changed? Credit markets have improved because of government guarantees and not due to any change in the inherent risks the bank balance sheets carry. So it is the government manipulation that is carrying the day and how long it will last is a moot point. Remember this is a shift of risk to taxpayers and politically not very conducive for the medium to long term.

The market sooner or later has to adjust to this reality. The E part of PE can be boosted by change in accounting but given that the underlying risk has not altered much, it will have to be factored-in the PE ratio with price adjusting at some point in time. Will it allow the real E to improve because banks can lend more, only time will tell? But given the way US unemployment and savings rate are growing the demand for goods is not going to move up in a hurry and so will demand for credit.

By incremental lending the risks that banks face in an environment currently prevailing will only increase its risk at the margin. Sample this from Shadow Government Statistics:

“BLS Jobs Reporting Is Seriously Flawed, at Best. This morning’s (April 3rd) reported March jobs loss of 663,000 again was close to consensus expectations, but, as has been common in recent releases, major downward revisions to prior reporting helped to mute the current headline jobs loss significantly. In each of the six most recent monthly payroll reports, the prior month’s payroll level was revised lower. For October 2008 to March 2009 reporting, the downward revisions to the prior month’s seasonally-adjusted payroll level were respectively: 179,000, 199,000, 154,000, 311,000 (still significant net of benchmark revisions), 161,000 and 86,000. Five of the six revisions exceeded the Bureau of Labor Statistics’ (BLS) 95% confidence interval of +/- 129,000 jobs for monthly change.

Net of revisions, the March jobs loss would have been 749,000. Net of the Concurrent Seasonal Factor Bias (CSFB), which reflects the reporting problems, the loss would have been 750,000, in line with my estimate in the March 29th Flash Update.

Payroll Survey: The BLS reported a statistically-significant, seasonally-adjusted jobs loss of 663,000 (down 749,000 net of revisions) +/- 129,000 (95% confidence interval) for March 2009, following an unrevised 651,000 jobs loss in February, but January’s jobs loss was revised from 655,000 to 741,000. Annual contraction (unadjusted) in total nonfarm payrolls continued to deepen, down 3.56% in March, versus a revised 3.10% (was 3.12%) in February. The annual decline in March was the deepest since July 1958. The seasonally-adjusted series also continued contracting year-to-year, down by 3.48% in March versus a revised 3.08% (was 3.02%) contraction in February."

Savings rates are expected to touch 10 to 12 percent.

And here is the icing on the cake. According to the above referred MarketWatch report:

“However, the battle over mark-to-market may not yet be over. Bankers are pressing lawmakers to urge FASB and its parent regulator, the SEC, to set up a procedure to retroactively recoup losses financial institutions have already taken on impaired illiquid assets.

House Financial Services Committee Chairman Barney Frank, D-Mass., told the American Bankers Association on Tuesday that he will take their concerns about reversing retrospective losses to the SEC and Congress. "They [bankers] ought to be able to go back and say they took that loss on an asset that is being held to maturity and recoup that loss," Frank said.

However, Willens said it would be extremely unusual for FASB to allow banks to go back and restate their existing earnings. "FASB doesn't traditionally do that, but Frank's pressure could make it happen," he said."

Post the new fair value rules we should have restatement of financials over the last five years so that we can compare ‘apple to apple’. Let’s see how things look if the entire ‘fair value gains’ are taken away. It would be revealing to see what PEG the markets were pricing-in and how it should re-look at it post the change in rules.

The past track record of banks in their ability and skills to value assets does not give any major comfort. The capability and the possibility of auditors doing so – the less said the better. In terms of evolving models we have seen how capable these banks were in risk modeling and managing it. It is very difficult to believe that they would do a better job this time and that such models will be neutral - not biased in their favor. The fact that bailed out banks are now looking to bid for the toxic assets under the Geithner plan says it all! In all probabilities it will now be a mutually beneficial exchange between them.

Disclosure: No Positions

Copyright © 2008-09 Tradesense

Saturday, March 28, 2009

FED Feeding the Markets – Will it Work?

Following this the Treasury prices surged and 10-year yields plunged about half of a percentage point, the biggest drop since the 1987 stock market crash. Also the US dollar plunged. This resulted in commodities mainly base metals and oil to move up and as the shorts covered the up move was magnified. The Giethner plan to handle bank toxic assets was also received well which gave more teeth to the rally.

Some concerns came back when as a Market Watch report says:

“On Wednesday, concerns were sparked after the United Kingdom failed to get enough bids to sell the full amount of 40-year gilts it offered, the first time this has happened in 14 years. Later in the day, a U.S. government auction of $34 billion of 5-year notes drew only tepid interest from foreign investors.”

The basic issue that arises is that will the huge funding required for the various avtars of the bailout plan succeed apart from the question marks on the plans success itself. In fact the reason for FED announcing the buyback of existing treasuries is in a way to make the Treasury sales successful. While one arm of the government buys keeping the upward pressure on prices the other sells. The deficit in 2010 is expected to be of the order of $1.25 trillion.

Says the above mentioned report:

"If the Fed is done six months from now, the Treasury market will be looking at the fiscal deficit and a huge amount of supply to come without the Fed being there" as a buyer”,…”

So the question now arises as to who buys these treasuries. Foreign buyers have become extremely wary (and many have their own set of equally grave issues to handle be it Europe or the Gulf countries) and the noise being made by the Chinese on a new world currency would be a cause for concern. Will China sell to FED and reduce its exposure? It is a certain possibility as it restructures its policy to focus inwards to the local economy and reduce dependence on exports.

This could also mean upward pressure on interest rates as the report mentioned continues:

“Ten-year yields now at 2.65% are likely to end the second quarter, in June, at 2.55%, according to a MarketWatch survey of 15 of the 16 primary government security dealers required to bid at auctions and that trade directly with the New York Federal Reserve. One firm did not reply to several requests for information.

That yield will rise to 2.84% by the end of the year, according to the survey.

Such a rise would mean investors, who in the past year have pumped more of their money into ultrasafe Treasuries and out of stocks and corporate bonds as a series of shocks rocked the U.S. financial system, would pull their money out of this corner of the bond market. Those freed-up assets could be good news for other parts of the financial markets that have lost out in the past year's flight to safety - such as stocks.”

Now here is the catch. On the one hand this would mean funding the bailouts is going to be more and more difficult and expensive while on the other hand liquidity will find its way to other asset classes. While the short term shift in liquidity to stocks and other assets may move these markets, sooner than later the reality of high interest rates and the inability/difficulty of funding the bailouts other than through FED buying more and more treasuries (printing money or quantitative easing) will become apparent. This we have experienced many a times is a sure shot formula for asset prices to finally form a bubble and lo! we are back to square one.

To me the market players should not get euphoric with current move. The players shifting their liquidity to the market to create such sharp moves would be actually shooting at their own legs. A measured slow consolidation is required and sharp move in asset prices will put the medium to long term sustained recovery in jeopardy. This whole process will be time consuming – running into number of years and the market player’s own action on a collective basis of how they handle this liquidity is going to determine how long the markets may take to make a long term sustainable up move.

Disclosure: No Positions

Copyright © 2008-09 Tradesense

Sunday, March 15, 2009

CDS, AIG & the rally in financials

"A credit default swap (CDS) is a credit derivative contract between two counterparties. The buyer makes periodic payments to the seller, and in return receives a payoff if an underlying financial instrument defaults.

CDS contracts have been compared with insurance, because the buyer pays a premium and, in return, receives a sum of money if one of the specified events occur. However, there are a number of differences between CDS and insurance, for example:

-- the seller need not be a regulated entity;

-- in the United States CDS contracts are generally subject to mark to market accounting, introducing income statement and balance sheet volatility that would not be present in an insurance contract;

-- The buyer of a CDS does not need to own the underlying security or other form of credit exposure; in fact the buyer does not even have to suffer a loss from the default event. Generally, to purchase insurance the insured is expected to have an insurable interest such as owning a debt."

According to a Bloomberg report:

“Credit swaps were created by JPMorgan Chase & Co. more than a decade ago to hedge against losses from bank loans. As dealers made the contracts more standardized, hedge funds, insurance companies and asset managers began using them to speculate on the creditworthiness of companies, sending trading in the swaps up to $47 trillion in 2008, according to the latest data from the New York-based International Swaps and Derivatives Association. “

How CDS would incentivize more bankruptcy?

“Amusement-park operator Six Flags Inc. and automaker Ford Motor Co. may be pushed toward bankruptcy by bondholders trying to profit from credit-default swaps that protect against losses on their high-yield debt.

By employing a so-called negative-basis trade, investors could buy Six Flags bonds at 20.5 cents on the dollar and credit- default swaps at 71 cents. If the New York-based chain defaults, the creditors would receive the face value of the debt, minus costs. In a Feb. 27 note, Citigroup Inc.’s high-yield strategists put that profit at 6 percentage points, or $600,000 on a $10 million purchase.

Investors who bet on the collapse of a company are pitting themselves against traditional debt holders at a time when Moody’s Investors Service projects defaults will more than triple this year to the worst level since the Great Depression. The clash may stall restructuring efforts to prevent bankruptcies, as basis traders may be less inclined to participate in distressed debt exchanges….

“Before, you really had to worry mostly about where you were in the” company’s capital structure, he said. “Now, you have to consider the possibility that you might have this large holder of CDS incentivized to see it go into bankruptcy. It’s something that’s going to come up more and more.”

More here...

Why CDS holders can be paid ahead of bankruptcy creditors?

As per an informative article in TPM

"…the knowledgeable people already know this. But it turns out that one of the features of the US 2005 Bankruptcy bill was to put derivative counter parties at the front of the line ahead of other creditors in bankruptcy proceedings. Actually … they don't just go to the head of the line… They got to skip the line entirely. As the Financial Times noted last fall, "the 2005 changes made clear that certain derivatives and financial transactions were exempt from provisions in the bankruptcy code that freeze a failed company's assets until a court decides how to apportion them among creditors." As the article notes, ironically, this provision which Wall Street pushed for and got to protect investment banks actually ended up hastening the collapse of Lehman and Bear Stearns last year.”

Does it have anything to do with non-disclosure of AIG’s counterparties?

TPM explains it thus:

“If AIG were to go down, derivatives counterparties would be able to seize cash/collateral while other creditors and claimants would have to stand by and wait. Depending on how aggressive the insurance regulators in the hundreds of jurisdictions AIG operates have been, the subsidiaries might or might not have enough cash to stay afloat. If policyholders at AIG and other insurance companies started to cancel/cash in policies, there would definitely not be enough cash to pay them. Insurers would be forced to liquidate portfolios of equities and bonds into a collapsing market.

In other words, I don't think the fear was so much about the counterparties as about the smoking heap of rubble they would leave in their wake.

Additionally, naming AIG's counterparties without knowing/naming those counterparties' counterparties and clients would be at best useless and very likely dangerous. Let's say Geithner acknowledges that Big French Bank is a significant AIG counterparty. (Likely, but I have no direct knowledge.) BFB then issues a statement confirming this, but stating it was structuring deals for its clients, who bear all the risk on the deals, and who it can't name due to confidentiality clauses. Since everyone knows BFB specialized in setting up derivatives transactions for state-affiliated banks in Central and Eastern Europe, these already wobbly institutions start to face runs. In some cases this leads to actual riots in the streets, especially since the governments there don't have the reserves to help out. If you're Tim Geithner, do you risk it? Or do you grit your teeth and let a bunch of senators call you a scumbag for a few more hours?”

So what does all this mean?

According to various sources on the Internet:·

--- The recipients of the largesse appear to be Goldman Sachs, Morgan Stanley, Merrill Lynch and Deutsche Bank.

--- News and banks analysts’ reports suggested that Goldman Sachs got about $25 billion of the government bailout of AIG and that Merrill Lynch was the second largest benefactor of the government largesse.

--- The earlier payouts as per The Wall Street Journal of December, citing a confidential document and people familiar with the matter, revealed that about $19 billion of the payouts went to two dozen counterparties between the government bailout in mid-September and early November. As previously reported, nearly three-quarters went to a group of banks, including Société Générale SA ($4.8 billion), Goldman Sachs Group ($2.9 billion), Deutsche Bank AG ($2.9 billion), Credit Agricole SA's Calyon investment-banking unit ($1.8 billion), and Merrill Lynch & Co. ($1.3 billion), the Journal reported at the time. A lot more has been doled out since then.

More than $170bn. has been committed till now and the reason why more is being committed is becoming clearer. Apart from receiving bailout money directly these very ‘super-financial-organisms’ could have their financials dented further if this route was also not kept flowing. Normally these institutions would have received only pennies on dollar on the CDS if bankruptcy was allowed. So what the government is protecting is further loss of tangible equity of these ‘hearts’ of the global financial system which can keep the ‘blood’(funds) circulating – trying to avoid a much bigger and more unbearable blood on the street. If my understanding is correct AIG’s CDS obligations exceed $500bn. And with CDS incentivizing bankruptcies be prepared for much more than the $170 bn. committed.

But the flip side is that it is preventing these ‘hearts’ from a heart attack. Apart from the technical factors the current rally in financials has after all got a fundamental perspective too!!

Is there a way out?

This Market Watch report makes it an interesting reading:

…“Bernanke said the counterparties made "legal, legitimate, financial transactions" with AIG and presumed at the time that the contracts would remain private. "That is a consideration we have to take into account," he added.

Sen. Mark Warner, D-Va., suggested that AIG's counterparties should have to take a "haircut," rather than be made whole, because some of them probably didn't do enough due diligence on whether the insurer was financially strong enough to be selling such protection.

"In effect, what we're saying is, consequently, folks who bought these instruments and that, at some point in their process, should have been doing some level of credit analysis of what AIG was selling who didn't do that credit analysis are going to still come out whole for their lack of appropriate due diligence or responsible behavior," he said.

"I'm as unhappy as you are about that, senator," Bernanke replied. "I just don't know what to do about it."

Given the current rally in the financials one can only hope despite this treatment (the largesse) to prevent a ‘heart/s attack’, its side effects do not make it fatal.

Disclosure: No Positions

Copyright © 2008-09 Tradesense

Monday, March 2, 2009

The beginning of the bottoming process

1. Financial Crisis sparks unrest in Europe

Read about a series of unrest in this region. I'am sure other regions too are reporting such instances.

2. Gold – Haring away

One is reading/hearing ‘Gold’ every where. Sure signs of panic are emerging.

“People have long viewed gold, rightly or wrongly, as a hedge against high inflation and a weak dollar. So when the gold price briefly broke through the $1,000 mark in March last year, it was easily explained by fears that rising commodity prices (and, in America, a weak dollar) would feed inflation. An earlier run-up in gold prices, between 2002 and 2005, coincided with a sustained fall in the dollar. But now gold is strong even as the dollar thrives and economies face deflation.

“Gold is something you buy if you have something to lose,” ... What links today’s gold fever with the 1970s rush is negative real deposit rates. Many savers now prefer a claim on gold in a vault to one on cash in the bank. There is less risk that a counterparty blows up, and the “carrying cost” of gold in terms of lost interest is, in any case, vanishing.

How high might the gold price go? Gold bugs talk excitedly about it reaching $2,300, which would match the January 1980 peak in real terms…”

3. Next Stop for Gold $2,000 Per Ounce!

“How high can gold ultimately go? Mark my words... gold will hit $2,000 per ounce or even higher.

Recently gold has been on an absolute tear as investors are piling into the yellow metal as a safety hedge. People are still quite concerned about the current economic crisis and are unsure what will happen in the future. The financial downturn we’re experiencing has crushed conventional investments like stocks and real estate and gold has shined throughout this downturn.

Gold is certainly in full bull market mode right now. Recently it headed higher on worries of both inflation and deflation. Surprisingly, central bankers are in favor of higher gold prices because it suggests their attempts to head off deflation are starting to work.

Now, the average person is not worried about inflation or currency debasement. They are worried about the money in their bank account. That’s just one reason that gold prices are rising. People are turning to safe havens because they think their banking system is on the brink of failure and they see the stock market is in the toilet.”

4. Stress Test Mess

The idea of ‘Tangible Common Equity (TCE)’ is bizarre. These sudden discoveries are just an exhibition of the fear factor. Tier I capital was what all bankers/regulators for long have looked at - through most good and bad times.

“Judged by tier-one capital, a common measure of adequacy, America’s ten biggest banks by assets appear in reasonable shape. Typically, their ratios of tier-one capital to risk-weighted assets exceed 10%). However, the quality of their tier-one capital has crumbled. Only about half now consists of tangible common equity, the purest and most flexible form of capital which bears the “first loss” when an asset goes sour. The rest is largely preference stock, much of it government-owned, which is not truly loss-bearing. For example, the dividends on Citigroup’s government preference shares can be deferred but not cancelled, unlike those on common stock. The original Basel rules on capital adequacy sought to limit such “hybrid” capital that sits between equity and debt. But most governments like preference stock because it does not carry votes, and thus avoids nationalisation, and because the more secure dividends protect taxpayers, providing the bank does not go bust.”

Just by transferring the money from one pocket to another you cannot create more cushion for loss provisions except for the dividend flow that you may save through such conversion to common stock.

While a bank is definitely obligated to pay interest on its borrowings – it makes money/profit or not – as regards preferred to the best of my understanding the bank is obligated to pay only if it can i.e. it has sufficient reserves and/or profits to do so. If it cannot, then it can cumulate based on the terms. And if at maturity it still cannot pay – period it cannot pay.

First there is a clamor that TCE is not sufficient and then when it is provided through some level of nationalization then the allegation is that you have moved away from the ‘Right’. So this ‘damned if you and damned if you don’t’ attitude shows the paranoia in the market where all logic seems to have been lost.

5. Even the best like Mr. Buffet who has sown the seeds of success on others fears and reaped the benefits from others greed has stated in his annual letter to shareholders that:

“During 2008 I did some dumb things in investments. I made at least one major mistake of commission and several lesser ones that also hurt. … Furthermore, I made some errors of omission, sucking my thumb when new facts came in that should have caused me to re-examine my thinking and promptly take action.

We're certain, for example, that the economy will be in shambles throughout 2009… and, for that matter, probably well beyond … but that conclusion does not tell us whether the stock market will rise or fall.

Whatever the downsides may be, strong and immediate action by government was essential last year if the financial system was to avoid a total breakdown. Had that occurred, the consequences for every area of our economy would have been cataclysmic. Like it or not, the inhabitants of Wall Street, Main Street and the various Side Streets of America were all in the same boat.”

Such desperateness and pessimism shows that even at such levels of knowledge, experience and expertise doom and gloom conversion is happening. A definite positive sign.

Read this conversation too.

6. The protectionists mess up is starting.

“President Barack Obama’s proposed removal of tax incentives for American companies outsourcing jobs could mean that large outsourcing customers such as GE and Citibank might have to pay certain taxes on their income from international markets, making it less attractive for customers to send IT projects to cheaper offshore locations…

However, experts argue that such protectionist measures are short-sighted because many US companies derive significant revenues from outside the country, and any protectionist stance could lead to a backlash in other markets. For instance, Citigroup in 2007 generated 52% of its revenues outside the United States, and over 60% of its workforce operated from abroad, as its banking business spanned 100 countries. Citigroup’s international revenue streams kept pace through 2008, despite the financial crisis, and amounted to a whopping 74% of the total revenues.”

These signs are by no means are exhaustive but do provide some vital pointers. As I see it we are some where close to beginning of the lower part of U and the bottom formation may run for a reasonably long period and may take a more flattish shape. How long, depends upon how the politicians across the globe play their cards.

Disclosure: No Positions

Copyright © 2008-09 Tradesense

Monday, February 23, 2009

Decoupling – have the seeds been sown?

Prima facie it appears to be a difficult proposition. The reasoning is very sound:

“Basically, there are two stories to tell here about the sudden downturn in the global economy.

The easiest to understand is the collapse of industrial production in East Asia, where the supply chain starts in places like Taiwan and Vietnam and moves through places like China and Japan before cars, shoes, computers and flat-panel TVs arrive at stores in the United States, Western Europe and everywhere else.

… the 40 percent decline in Taiwan's industrial production at the end of last year was the "canary in the coal mine" of Team Asia's formidable export machine. At about the same time, Japan's exports fell 35 percent, Korea's 17 percent, and China's fourth-quarter gross domestic product was essentially flat -- no economic growth at all.

… never seen declines this fast and this steep, even during the Asian economic crisis ... It all reflects not only the sharp pullback in discretionary consumer spending around the world but also an equally sharp pullback in the flow of foreign investment that was used to build factories and shopping centers and has been an important driver of growth in the region.

Demand for Asian exports will pick up again before too long, but it will be a long time before they reach the levels attained at the height of the bubble economy. And it will be longer still before foreigners will be eager to invest in expanding capacity again.

Ideally, Asians would respond to this challenge by reducing their heavy reliance on exports and foreign investment and reorienting their economy more toward domestic consumption. But … that's not as simple as it sounds.

For starters, the things Asians might want to consume aren't necessarily the things they produce to export, so production would need to be reoriented and workers retrained and redeployed. And to replace the foreign investment, these economies would need to develop financial institutions that can raise and invest risk capital, which right now they don't really have. Most significantly, Asian governments would have to create safety-net programs like Social Security so people don't save so much and spend so little.

In short, the Asian downturn is probably manageable, particularly now that the Chinese government has responded with a massive stimulus package. But it will take time for the region to make the necessary adjustments to get the region humming again.”

As I see the lessons learnt/being learnt during this severe downturn will have a lasting impact as these Asian countries now re-orient there industrial and fiscal policies to ensure that over dependence on exports is reduced in the years to come. Also trade within the region will now be a much greater focus as two of the most populous countries in the region ‘Chindia’ look to push their growth with policies that are much more domestic investment and consumption oriented. India always was domestic consumption story (save the IT and IT enabled services and Generic Pharmaceutical industry) and now can be regarded as a great advantage.

As the quote above points out - the reorientation will be challenging and will take time – a decade or so. But as the US and European consumption story sees its twilight in years to come it is the Asian and some of the resource rich countries such as Brazil that will need to fill-in. And as this re-orientation sees initial success foreign capital (US and European savings) will start seeking these countries and the capital required to sustain a reasonable growth rate will find its way. The seeds for this shift – possibly a power shift too - appears to have been sown.

Disclosure - No Positions

Copyright © 2008-09 Tradesense

Monday, February 16, 2009

Warning Signal

Thursday’s movement of US stock prices will tell us a lot about it! Just when one thought that the supports were to give way the market rebounded and bulls took-off.

And there appears to be some tactical work behind this. As one writer put it –

“I figured out why Geithner was so vague in his speech Tuesday... now each time the market is weak and about to fall off a cliff they can release another piece of "salvation" - this methodology could last for months. Why shoot your load all at once?? Genius! I tell you there must be an army of technical analysts employed somewhere in the bowels of government. Their timing is beyond impeccable; below S&P 800 and the panic would have begun.”

Any major move by the market on the down side is likely to be manipulated with timed releases/leaks it appears. Well the market will turn out to be savvier. If it reads the emerging situation is not to its liking and decides to go down – it will! Experience tells me it can find its way if that is what is right in its perception. It will probably consolidate downwards instead of making a big move.

There was a feeling that the markets were stabilizing and credit in some measure was beginning to flow. Some liquidity it appeared had started flowing towards to the equity markets as players booked profit in treasuries - treasury yields improved. But last week’s market behavior probably indicates that some more turbulence is likely. This Bloomberg report brings out the point:

“Ten-year note yields fell the most in two months as investors, disappointed at the lack of details in Treasury Secretary Timothy Geithner’s bank-bailout plan and doubtful a stimulus package will spur growth, sought the safety of government debt. Stocks tumbled. The government, meanwhile, sold a record $67 billion in notes and bonds.

The benchmark 10-year note’s yield dropped 10 basis points, or 0.10 percentage point, the most since the five days ended Dec. 19, to 2.89 percent, ... Yields on the two-year note fell three basis points, the most since the week ended Jan. 9, to 0.96 percent. Thirty-year bond yields slipped two basis points to 3.67 percent.

The 10-year note yield touched 2.04 percent, the lowest according to data going back to 1953, on Dec. 18, the same day the 30-year bond yield fell to a record 2.51 percent. The declines came two days after the Federal Reserve cut its target overnight rate to a range of zero to 0.25 percent and said it was considering buying “longer-term” Treasuries to lower consumer borrowing costs and stimulate the economy.

On Feb. 9, as the government readied the week’s auctions, the yield on the 10-year note reached 3.05 percent and the yield on the so-called long bond touched 3.76 percent. The yields were the highest since November.